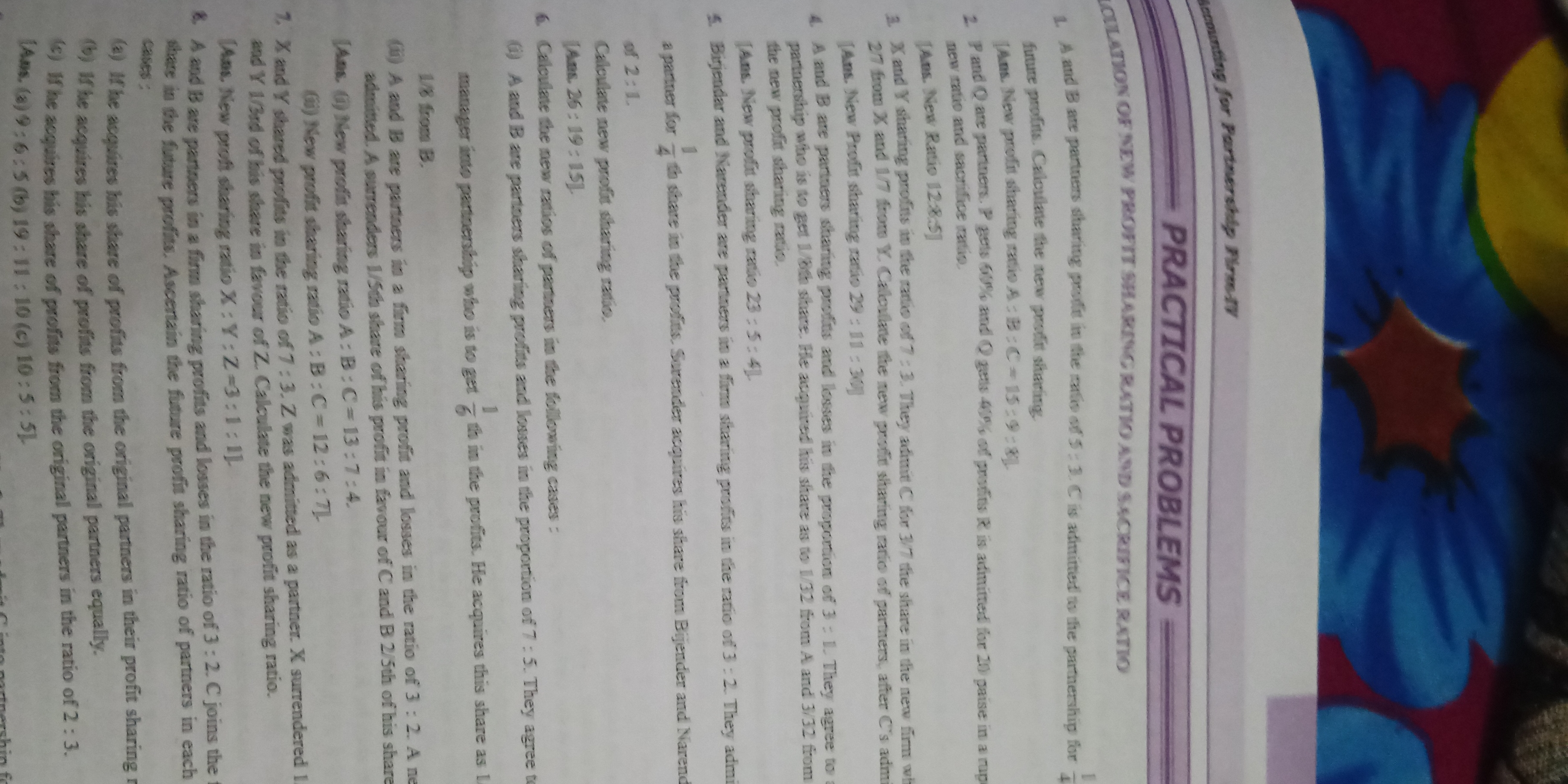

A, B, and C are partners sharing profits in the ratio of 3:2:4. A introduces D as a new partner, sharing profits in the new ratio of A:B:C:D = 13:7:4:2. Calculate the new profit sh... A, B, and C are partners sharing profits in the ratio of 3:2:4. A introduces D as a new partner, sharing profits in the new ratio of A:B:C:D = 13:7:4:2. Calculate the new profit sharing ratio.

Understand the Problem

The question provides several scenarios of profit sharing and partnerships, asking for calculations related to the new profit sharing ratios and contributions of various partners. It involves resolving ratios and percentages in financial partnerships.

Answer

The new profit sharing ratio is $3 : 2 : 1$.

Answer for screen readers

The new profit sharing ratio is $3 : 2 : 1$.

Steps to Solve

- Identify the Current Profit Sharing Ratio

The current profit sharing ratio between A and B is given as 3:2.

- Calculate Total Ratio Units

Add the ratio parts together: $$ 3 + 2 = 5 $$

- Determine New Partner's Share

C is introduced as a new partner and is allocated a share of $ \frac{1}{6} $ of the profits.

- Calculate Remaining Profit Share

Calculate the remaining profit share after giving C his share: $$ \text{Remaining share} = 1 - \frac{1}{6} = \frac{5}{6} $$

- Redistribute Remaining Profit Share

A and B will now share the remaining profit of $ \frac{5}{6} $ according to their original ratio. For A and B:

- For A: $$ \text{A's new share} = \frac{5}{6} \cdot \frac{3}{5} = \frac{3}{6} = \frac{1}{2} $$

- For B: $$ \text{B's new share} = \frac{5}{6} \cdot \frac{2}{5} = \frac{2}{6} = \frac{1}{3} $$

- Calculate Final Profit Sharing Ratio

Now combine A's, B's, and C's shares:

- A's new share: $ \frac{1}{2} $

- B's new share: $ \frac{1}{3} $

- C's share: $ \frac{1}{6} $

To express these in a common ratio, convert to a common denominator (6):

- A: $ \frac{3}{6} $

- B: $ \frac{2}{6} $

- C: $ \frac{1}{6} $

So the new profit sharing ratio is: $$ 3 : 2 : 1 $$

The new profit sharing ratio is $3 : 2 : 1$.

More Information

In this scenario, introducing a new partner can lead to a significant change in the profit distribution among existing partners. The calculation demonstrates how profit shares need to be adjusted based on the new partner's contribution and share in the profits.

Tips

- Forgetting to account for the new partner's share correctly.

- Not redistributing the remaining profit share according to the original ratios of the existing partners.

- Calculation errors when converting fractions to a common denominator.

AI-generated content may contain errors. Please verify critical information